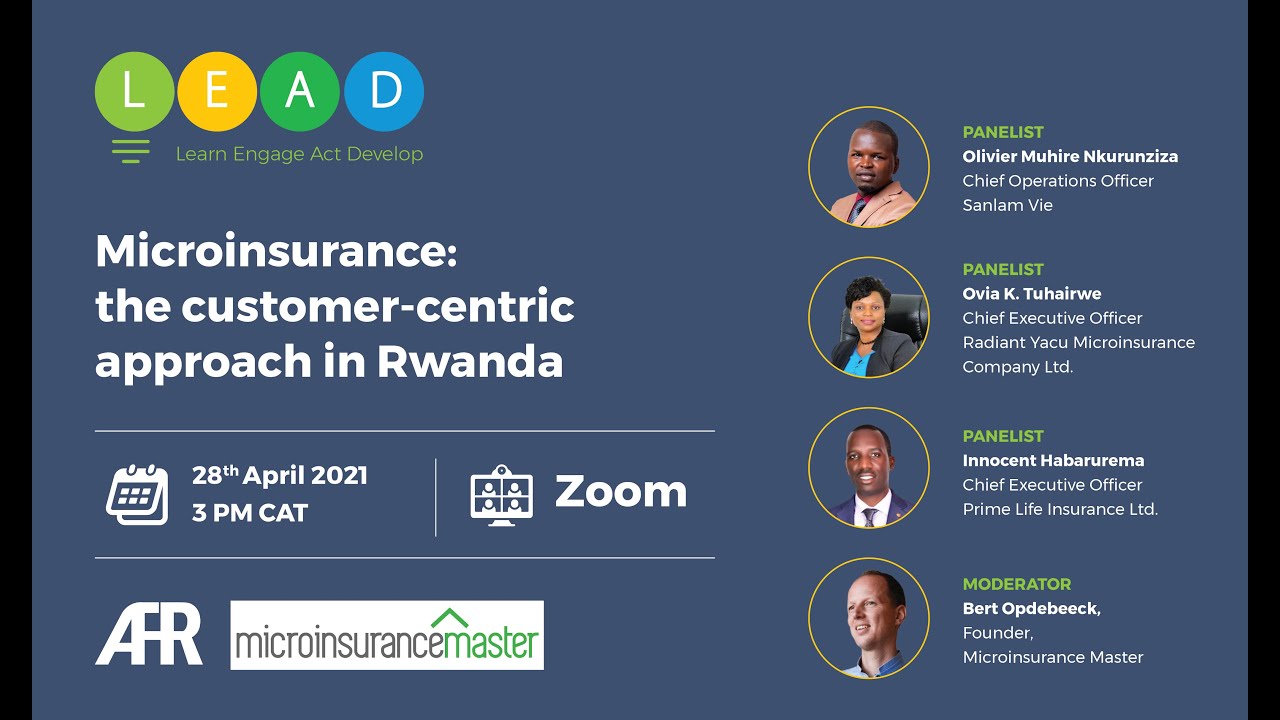

LEAD Series

AFR LEAD Series bring experts together to discuss best practices for developing Rwanda's financial sector. These monthly 90-minute roundtables connect various stakeholders, including financial providers, policymakers, and entrepreneurs. The series aims to facilitate networking, learning, and problem-solving to address pressing issues in Rwanda's financial development and economic transformation. By fostering knowledge sharing and collaboration, AFR LEAD Series seek to tap into untapped potential in the Rwandan financial market.

Edition of the series

0

- All LEAD Series editions

LEAD Series

6 Videos