Objectives of the report:

This report is prepared from the findings of the FinScope Rwanda Survey conducted in 2020 and aims at providing a comprehensive analysis of the Rwandan agriculture finance sector.

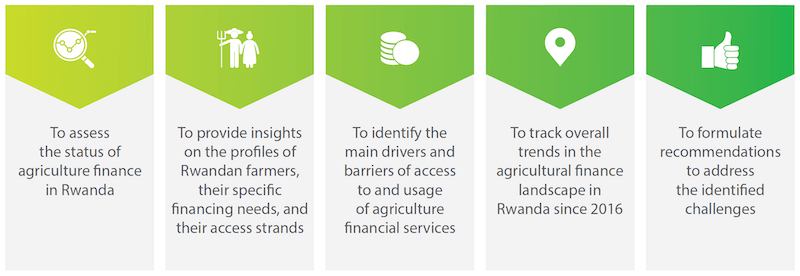

The specific objectives of the present report are as follows:

Objectives of the report:

FinScope Rwanda 2020 is representative at national, urban/rural and district levels. The sampling frame was provided by the National Institute of Statistics of Rwanda. The sample was designed according to the latest Census through the listing information conducted in the selected Enumeration Areas (EA). All households in the selected EAs were listed. As such about 158 386 households were listed. Within each selected EAs, sixteen households were randomly selected from the listed households. Within the selected households, individual respondents were randomly selected using the automated Kish Grid. A total of 12,480 interviews were conducted during September to November 2019 by Centre for Economic and Social Studies. The data was weighted and benchmarked to the 2016/17 Integrated Household Survey (EICV5).

This agricultural finance thematic report was prepared using both the FinScope Rwanda 2020 and the FinScope Rwanda 2016. The analysis focuses specifically on agriculture finance, meaning the landscape of access to and usage of financial services for farmers to finance their agricultural activities. For the data analysis, our target is the adult population of Rwanda (16 years old and above), segmented between adults who are engaging in farming activities, whether for their consumption or as a commercial activity and the rest of the population.