Rwanda like many other countries have seen digital finance as a key enabler of financial inclusion. Over the past decade, considerable progress has been registered in promoting the use of digital financial services in the country. Indeed, the use of technology in the financial sector has brought a wide range of financial products and services that are accessible via mobile phones, internet banking and other digital channels which, in return, promote access to and usage of financial services.

In order to track progress in the uptake of digital financial services, Access to Finance Rwanda (AFR) in collaboration with Key stakeholders conducted the 2020 Finscope survey and produced a Digital Financial Services (DFS) thematic report that assesses the status of access and use of DFS in Rwanda and identifies specific barriers and constraints. The Finscope 20202 digital financial inclusion thematic report also propose policy recommendations and potential interventions to address the identified constraints.

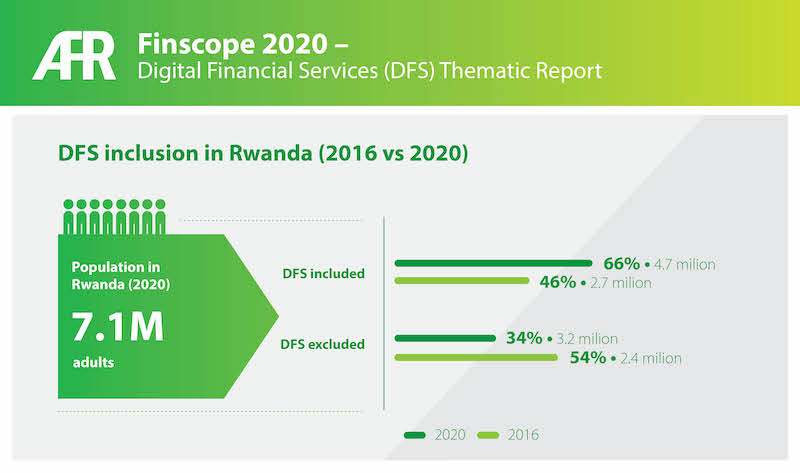

Where does Rwanda stand in terms of digital financial inclusion?

The analysis shows that in 2020, around 66% out of the total adult Rwandan population (7.1 million) are digitally included up from 46% in 2016. This is mainly driven by mobile money access and usage (91%) as well as access and usage of banks electronic services (9%). The penetration of mobile money stood at 60% in 2020 up from 39% in 2016.From a gender lens, there is still a 9% gap, where 71% of men are digitally included versus 62% of women. Further, the analysis shows that the digital exclusion has decreased by 20 percentage points moving from 54% in 2016 to 34% in 2020. DFS exclusion is high in rural areas compared to urban areas at 43% and 7% respectively mainly due to the lack of awareness and access to digital tools.

Commercial banks and mobile money are the biggest drivers of DFS uptake. Based on the DFS thematic report, in 2020, around 94% of commercial banks and 85% of mobile money operators offered electronic services (e-wallet services). In 2020, around 30% of Rwandans used DFS to facilitate payments, compared to around 19% in 2016. This segment actively uses their financial transactional accounts and self-originates these transactions themselves. DFS payments in Rwanda are mainly made via digital channels including banks’ online transfers, credit /debit / Automated Teller Machines (ATM) cards and mobile money.

Access to digital infrastructure is a key enabler of DFS inclusion

The DFS thematic report 2020 reveals that 86% of adult Rwandans had access to a phone as of 2020, this being a prerequisite to access DFS and usage, compared to 85% in 2016. The number of Rwandans having access to a computer and the internet was comparably low in 2020, with only 18% having access to a computer and 23% to the internet. However, these figures have grown since 2016, where only 13% had access to a computer and 16% to the internet.

Broader challenges that hinder the usage digital financial services

Awareness of existing DFS solutions is vital to ensure usage. From the FinScope 2020, it became clear that while awareness of DFS products is almost equal across gender, there are variations on awareness of some DFS aspects such credit / debit cards (male: 45%; female: 37%) and internet banking (male: 30%, female: 23%). Moreover, the lack of awareness becomes an even bigger problem when comparing urban and rural settings, with the rural population being much less aware of existing DFS products resulting from a low distribution of Financial Access Points (FAPs) in rural areas. This is visible with regard to the awareness of credit/ debit cards, where 70% of men are aware of this service but only 30% of women.

What is needed to further develop the Rwandan DFS market:

Update of Financial Literacy and Training strategy: Low financial literacy is a major obstacle (to greater financial inclusion) and which has a direct impact on DFS usage and financial behavior more generally. Financial literacy programs are essential in the process of enabling the population to make better economic decisions and to consequently generate wealth.

Policy and regulation for Micro Small and Medium Enterprises (MSMEs) to accept digital payments: Merchant payments are part of digital inclusion and are a key enabler for E-Commerce and a digital economy more generally. Making it mandatory for businesses to have at least one digital application channel for rising or receive payment would increase digital inclusion and lead to cashless economy which is part Rwanda’s agenda. The cost of online payments was cited as one of the hurdles for merchants to grow their businesses to reach scale, therefore it is recommended to reduce or remove the costs of digital transactions through: bank charges for customers and small merchants when doing digital payments ,subsidizing costs of low value transactions, and removing/lowering import duties on digital tools including (POS devices and smart phone).

Support policy and regulation to develop an enabling environment for QR codes: QR codes (scan to pay technology) have the potential to significantly accelerate digitisation of economic activities in Rwanda and pave the way for tailored customer services. To attain this QR code, merchant payments have several key enablers and interdependencies: device affordability, internet connectivity, wallet/bank account penetration and merchant distribution, all which must be addressed to increase chances of success